A Letter to Our Ross County Community

From the Ross County School Superintendents, Treasurers, and Board Members of Chillicothe City Schools, Pickaway Ross Career and Technology Center, Ross-Pike Educational Service District, Union-Scioto Local, and Zane Trace Local.

Dear Ross County Residents,

As your local school leaders, we write to you not as politicians or advocates, but as fellow parents, neighbors, and stewards of the public education system that lies at the heart of Ross County.

Like you, we are taxpayers who feel the weight of rising property taxes. We understand the frustration and concern those bills bring. But today, we must share the full picture of what’s happening across our state — and how it affects the services that define our communities.

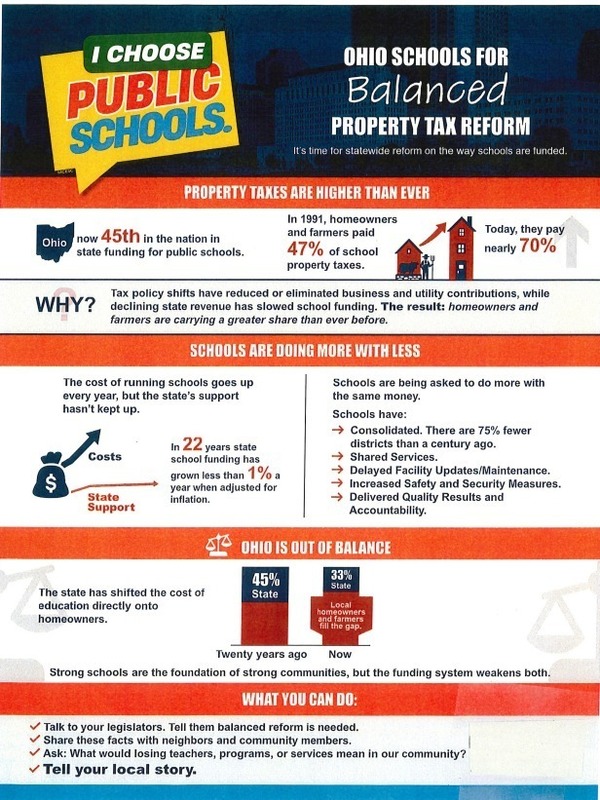

The Numbers Don’t Lie: Ohio Has Shifted the Burden to Local Taxpayers

Over the past two decades, state lawmakers have gradually shifted how Ohio funds education — and, in doing so, who pays the bill.

Here are the facts:

In 2002, Ohio ranked 35th nationally in state funding for K–12 education.

By 2023, we had fallen to 45th, among the lowest in the nation.

The state’s share of education funding dropped from 44.8% to just 33.5%, more than 11 percentage points below the national average.

Meanwhile, local property taxes now account for 53.1% of education funding — among the highest in the country.

What does this mean for Ross County?

While the national average shows states funding about 45% of education costs, Ohio funds only 33.5%. Local communities like ours are forced to make up the difference.

We’re not overspending; we’re being asked to fund education differently — through local property taxes instead of state resources.

This Impacts More Than Just Schools

Proposals to significantly reduce or eliminate property taxes may sound appealing during tax season. We understand that impulse completely.

But in Ross County, property taxes don’t just fund our schools — they sustain the core services that make this a strong and vibrant place to live.

Consider what billions in lost local revenue could mean:

Our children’s schools — from classroom resources to student safety and academic programs.

Fire and emergency services — the first responders who keep our families safe.

Local roads and infrastructure — the routes that connect our homes, jobs, and schools.

Community programs — parks, senior centers, and public services that strengthen our quality of life.

Our Children Deserve Better Than Political Soundbites

Every child in Ross County deserves the same opportunities we had growing up — caring teachers, safe learning environments, and educational programs that prepare them for future success.

These are not luxuries; they are essential investments in the next generation of Ross County citizens.

The problem isn’t mismanagement at the local level — it’s long-term state disinvestment.

When Ohio drops from 24th to 41st nationally in state revenue per pupil, and our state funding per student is now $2,672 below the national average, the burden inevitably falls on local taxpayers.

A Call for Real, Responsible Solutions

We are not writing to defend the status quo or to ask you to accept higher property taxes simply. We are writing because Ross County — and our children — deserve honest, sustainable solutions that don’t jeopardize the services that make our county strong.

Real property tax relief must begin with the State of Ohio fulfilling its constitutional responsibility to fund public education adequately.

Forty-four other states have found a better balance — Ohio can too.

Meaningful, Responsible Reform Could Include:

Targeted Relief for Those Who Need It Most

Expanded property tax relief for seniors on fixed incomes

Additional exemptions for citizens with disabilities

Strengthened homestead exemptions for low-income families

Sustainable Growth Protections

Revenue growth limited to prevent unsustainable year-over-year increases

Caps tied to inflation and income growth to maintain affordability

Automatic community review when increases exceed reasonable thresholds

Local Control and Transparency

Greater flexibility for local governments in managing tax abatements and incentives

Stronger transparency requirements for how incentives and exemptions are granted

Consolidation as a Potential Outcome

If funding challenges continue, school or district consolidation may become a realistic outcome. While consolidation may appear to reduce costs, the overall cost savings are uncertain. They could lead to unanticipated expenses, longer bus rides, and economic harm to many of our local communities.

Our focus will always be on protecting students, preserving programs, and ensuring every child continues to have access to quality education. We promise to continue fighting for Ross County kids.

Moving Forward Together

The path forward will require Ross County residents, educators, and elected officials working together to demand that Ohio provide fair state funding for education while pursuing responsible property tax relief.

Other states have achieved this balance — and so can we. We encourage you to stay engaged and extend an invitation to meet with your school district officials. The future of our schools — and the strength of Ross County — depend on it.

Thank you for your continued support of public education and for being a community that always puts children first.

Sincerely,

Ross County School Superintendents, Treasurers, and Board Members from Chillicothe City, Pickaway Ross Career and Technology Center, Ross-Pike Educational Service District, Union-Scioto, and Zane Trace Local.